"Whenever in the judgment of the Secretary of the Treasury such action is necessary to protect the currency system of the United States, the Secretary of the Treasury, in his discretion, may require any or all individuals, partnerships, associations and corporations to pay and deliver to the Treasurer of the United States any or all gold coin, gold bullion, and gold certificates owned by such individuals, partnerships, associations and corporations. Upon receipt of such gold coin, gold bullion or gold certificates, the Secretary of the Treasury shall pay therefor an equivalent amount of any other form of coin or currency coined or issued under the laws of the United States."

Emergency Banking Relief Act of 1933, U.S. Statutes at Large (73rd Congress, 1933 p. 1-7) – Amendment (n) to Section 11 of the Federal Reserve Act. Approved, March 9, 1933, 8.30 p.m.

Many reasons are offered to explain Central Bank sales of gold. The one most often offered is a lack of return. Holding another Government’s bonds earns interest but gold has a storage cost. Holding sovereign risk is the reason for the difference in return and presently buying sovereign risk is still in a bull trend. Gold on the other hand is free of credit risk and should gain when sovereign risk becomes unpalatable. The current race to zero interest rates, a race for 2nd place as Japan has already won, pose an intervention risk for gold price formation.

The much valued return on government bonds is now more than counterbalanced by a risk of capital loss should interest rates start to rise. Then again why would interest rates rise? Japan has been at near zero interest rates since September 1995 when it first plunged below the 1% level. Thirteen years below 1% and the clock is still ticking. The USA seems to be playing follow-my-leader.

Exhibit 1

Data Source: Japan Basic Discount Rate – Bank of Japan series: Policy Interest Rates and Money Market Rates in Major Economies. USA Target Rate - Board of Governors of the Federal Reserve System series: DFEDTAR month end data.

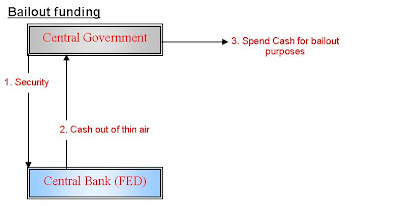

There is only one way to get to an interest rate below 1% and that is the route of money creation. Use expansive monetary policy to flood the market for debt with money created from nothing and rates can be forced to below 1%.

Exhibit 2

A consequence of such an expansive policy is a lower return on Central Government Bonds. The rational expectation would be that Gold would under these circumstances be well placed to compete with Government Bonds.

Exhibit 3

It is exactly at the point where Gold becomes a competitive threat to money when the first part of the above quote becomes important: “Whenever in the judgment of the Secretary of the Treasury such action is necessary to protect the currency system of the United States”. It is not in the interest of the Central Government to allow Gold a competitive advantage over currency.

The expansive monetary policy is inflationary for the price of Gold and will make Gold increasingly attractive as an alternative store of value. The inflationary effect on Gold should in theory protect the holder against a constant devaluation of the currency.

Both the fiscal and monetary authorities cannot allow Gold to become an effective competitor for the currency. Steps would therefore be taken to manage the competitiveness of Gold relative to the currency

This is not a conspiracy theory. These are rational and logical steps which must be taken to protect the currency. A high interest rate will automatically afford a currency protection against Gold. A policy of near zero interest rates or even zero interest rates will make a currency vulnerable to any stores of value. Gold as the most traditional store of value will then be targeted for management. It is not significantly different form targeting an artificial interest rate. One intervention necessitates another.

Exhibit 4

Exhibit 4 shows a 1 year return and a 3 year return on an investment in gold at a monthly average price for entry and exit. The theory of inflation would have one expect that Gold would outperform Government Bonds under an expansionary monetary policy regime. Gold should therefore under monetary conditions of extreme liquidity accelerate equally in price. Yet, every attempt to outperform collapsed. Lately the Gold price has been under pressure.

It is clear from Exhibit 4 that monetary policy will fail should Gold be allowed to raise consistently as a result of easy monetary conditions. Gold would absorb newly created money and short-circuit the monetary stimulation. Contemplate the dilemma of a FED creating debt against a Gold liability. It would become a de facto return to a Gold Standard. Proactive management strategies will be undertaken to avoid such an outcome.

The second part of the quote above contains the alternative strategy in the event that the steps taken to negate the competitiveness of Gold fail. The holders of Gold will be forced to exchange the Gold for currency on such terms as the Central Government will dictate.

Central Banks across the globe cooperate on monetary policy. They will all cooperate to prevent outcomes which will reduce the efficiency of their policies.

"…in an unprecedented joint action with five other major central banks and in response to the adverse implications of the crisis for the economic outlook, the Federal Reserve, again, eased the stance of monetary policy. We will continue to use all the tools at our disposal to improve market functioning and liquidity, to reduce pressures in key credit and funding markets and to complement the steps that treasury and foreign governments will be taking to strengthen the financial system."

Ben S. Bernanke, The Economic Club of New York –– October 15, 2008, pp 4

The now very obvious global monetary choice is a choice for Stasis. Containment of the financial crisis. All economies get stuck in a downward spiral similar to the example of Japan. Monetary authorities provide unlimited liquidity to sustain Stasis. A rising Gold price will not be tolerated under these conditions.

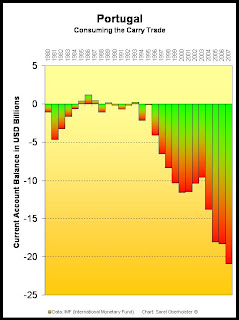

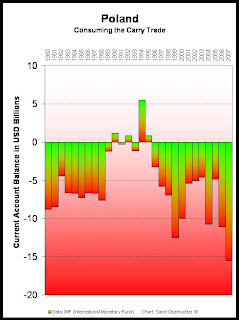

The market risks are not that easily overcome. Every step taken to sustain Stasis on a global scale holds the risk of weaker countries failing. Sovereign risk will cause funding limitations and currency depreciations. Gold will become attractive given such an outcome.

The ultimate risk is currency failures. Monetary policy taken to the zero bound invites currency failure. Japan’s economy was structured to encourage a weak yen for an economy positioned strategically to export to the rest of the world. How many other economies can say the same? How long can the structural imbalances and stresses be held in Stasis with unlimited liquidity?

The monetary policies of Stasis will include the management of the Gold price. Gold will become prohibitively expensive should control over the global structural distortions be lost in spreading hyperinflations. Understand the smoke and mirrors of monetary policy. Understand the risks of facing off against the FED. Be extremely aware of entry and exit points when trading in Gold. Comprehend the signals when the first Hyperinflationary episodes appear. Only those who have physical gold stored outside the jurisdiction of their governments will be protected when their currencies collapse.

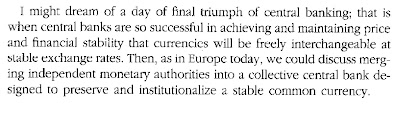

I leave you with a final quote form Paul Volker’s 1990 Per Jacobsson Lecture (p17, published by the graphics section of the IMF)

Sarel Oberholster

BCom (Cum Laude) CAIB(SA)

6 December 2008

© Sarel Oberholster

Please email me at ccpt@iafrica.com with any comments. More links and essays can be found on my blog at http://sareloberholster.blogspot.com/ .

The reality of fiscal irresponsibility

A genuine Zim note, given to me at Joburg airport as a novelty. It is worth a couple of dollars US.

Kind regards

PETER DAWE