An urban legend claims that one has the protection of an angel when you drive your car at 100kph (about 63mph) or less. Accelerate and the angel gets out while the devil gets in. Exceed 200kph (about 125mph) and the devil also gets out. Long has the rule of thumb in economics been that a country should not exceed 3% of GDP as a Current Account deficit, a country's overdraft with the rest of the world so to speak. Exceed 3% and the devil gets in. However, some countries are now exceeding even 6% of GDP as a Current Account deficit and even the devil has deserted them. Surely driving your economy at a deficit of 6, 7 or 9% (or more) is an accident waiting to happen. Such deficits would normally have been punished severely in exchange rate depreciation. Carry trades and extreme provision of liquidity by Central Banks behind it, has facilitated a growth in deficit trading without the pain of sudden and severe exchange rate depreciations. Countries can and do live beyond their means while consuming the carry trade. Much like mortgage borrowers could consume fictional real estate values for a while. Who are these countries?

Chart 1

© Sarel Oberholster Data Source: International Monetary Fund - Current account balance; Percentage of GDP 2007. (*IMF 2007 Estimates)

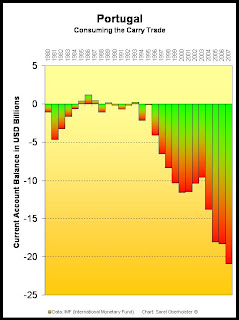

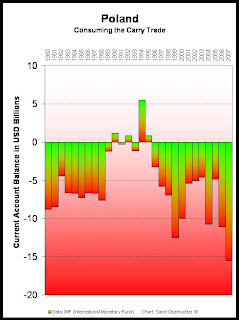

In identifying the countries I have eliminated those countries with a GDP of less than US$100billion for the same period. Australia, South Africa, New Zealand, Portugal, Spain, Greece and Romania are driving their Current account deficits in serious crash territory. Poland, Ireland, UK, Pakistan, USA and Turkey are way beyond responsible Current account management. Moving on to the relative importance of each of these countries requires quantifying each deficit in a single currency.

Chart 2

© Sarel Oberholster Data Source: International Monetary Fund - GDP in USD Billions 2007 (may include IMF 2007 Estimates).

The relative size of the deficits in a single currency unit must be established to discern the relative importance of each country's deficit on a world economy scale.

Chart 3

© Sarel Oberholster Data Source: International Monetary Fund - 2007 GDP in USD Billions multiplied by the Current account balance; Percentage of GDP 2007 (may include IMF 2007 Estimates).

Chart 1 shows the extent to which these countries live beyond their means. Chart 2 shows the relative importance of each of the deficit countries in the global economy and Chart 3 shows the relative usage of current account deficits again in a global context. These charts do not deal with the compounding of deficits. They only deal with what happened last year. One further detail is required to complete the picture. How much are these countries paying? Countries pay in currency depreciation which shows up as imported inflation in their countries and more directly, they pay in interest.

Chart 4

© Sarel Oberholster Data Source: Central Bank benchmark rates have been obtained from the respective Central Bank websites.

Romania, South Africa, Pakistan and Turkey have to pay for the privilege of living beyond their means and to protect the relative exchange rates of their countries while they live the high life courtesy of the carry trade. The UK, Poland, Australia and New Zealand get an easier ride. Spain, Portugal, Ireland and Greece have the best of both worlds driving solid Current account deficits while under the protection of the EU. Nobody has a sweeter deal than the USA. It gets to drive a reckless 5.3% of GDP deficit and consumes 58% of the total share of the identified deficit living group (the rest get less than half!). Best of all it comes at a bargain basement price of 2%pa interest. Perhaps the world reserve currency status of the USD will continue to protect the USA. Perhaps I can drive my car at 600kph and not crash.

Somehow I think it is simply too good to be true and each of these countries will face the consequences, some sooner than they may expect. Do they also believe that Regan had proved deficits do not matter? I know I need a currency hedge, how about you?

Sarel Oberholster

BCom (Cum Laude), CAIB(SA).

August 2008

Please email me at ccpt@iafrica.com with any comments. More links and essays can be found on my blog at http://sareloberholster.blogspot.com/ .

Charts showing the trend in Current Account Deficit accumulation for each of the individual countries discussed in this article have been posted on my blog at http://sareloberholster.blogspot.com/ .

© Sarel Oberholster - 2008