Fractional Banking, the Money Multiplier and money creation by banks are economic concepts that need updating. Failing to do so will expose you to almost limitless taxation by stealth. Nothing is safe, not your income, or your wealth; even your pension is there for the taking.

Fractional banking is a derivative of the money multiplier theory, which works like this. A bank receives a deposit, which can then be recycled and multiplied throughout the banking sector subject to the “fraction” that a bank will or are obliged to retain as a “reserve” against withdrawals. Say the reserve is $10 out of $100, then the 1st deposit-receiving bank can lend out $90, the money recycles in the economy and ends up as a $90 deposit with the next bank who in turn will “reserve” $9 and lend out $81, ad infinitum until the fractions simply gets to small to matter. Not a complicated theory at all, only starting at the wrong place. The very 1st $100 is the only “money” the rest is simply an assumption about credit distribution. The multiplication may or may not happen. Of more importance is that the existence of “reserving” will act as a natural brake on the extent of credit distribution in any economy. This is the first area where updating is required.

The advent of a standardised worldwide approach towards bank supervision as new monetary policy embodied in the Basel Accords (Basel I – the 1988 Capital Accord and Basel II - 2001) have effectively superseded “reserving” as part of monetary policy. You can read up and find these accords at the BANK FOR INTERNATIONAL SETTLEMENTS, Basel Committee on Banking Supervision by following this link http://www.bis.org/bcbs/ . Implementation guidelines for the Basel II accord can be found at this link http://www.bis.org/publ/bcbs109.pdf .

These accords changed the focus of credit creation by banks as managed by central banks. All forms of credit and banking risks are graded (“risk weightings”) and banks are required to hold a prescribed percentage of capital against each class of risk. These are called capital co-efficients and banks must then comply with “Capital Adequacy Ratios”. It follows that capital adequacy ratios have taken over from fractional reserving as the limiting variable in credit creation by banks. The size of the reserving “fraction” has become so small such as to all but eliminate it as a brake on credit creation.

The new overarching credit creating policy variables are the Capital Adequacy Ratio from Central Bank Supervision over banks and Liquidity Accommodation to banks. First let’s look at Capital Adequacy.

The Capital Adequacy Ratio for banks under Basel II is generally targeted at 12% by 2005. This simply means that a bank’s capital must equal 12% of the sum of its risk exposures. A simplified example would be that a bank’s Capital Requirement would be $12 if it has advances of $100. It gets a bit more complicated with different “tiers” of capital and the fact that the $12 may also be lent out, but the fundamental principle of the example holds true irrespective. Risk weightings make up the sum of the risk exposures.

The risk weighting for standardised credit risks is 100% (the vast majority of all Bank lending other than residential mortgage lending, lending to government and public sector entities, and lending to other banks). This only means that the full 100% of the $12 shown in the above example will apply.

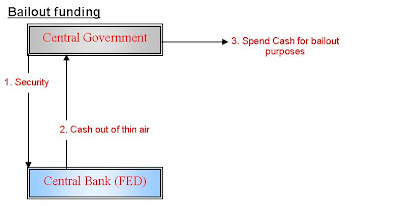

Special rules of “risk mitigation” apply to certain classes of loans made by banks. Residential mortgage advances of high quality can get risk weighted as low as at 35%. Again a simple process. $100 of these mortgages will get only 35% of the normal $12 Capital Requirement i.e. $4.20, which translates to almost 3 times as much Residential mortgage lending at the original $12 capital. Lending to governments can be as low a risk weighting as zero but normally would not exceed 10% as a risk weighting. That means banks can lend to government 10 times more than to anybody else, as a worst case scenario, but at a zero rating, banks can lend to government an unlimited amount. Hang on to this principle for it is part of a simple circular process to create unlimited government funding via the banking sector, for the Fed will supply the banks with all the “money” they need to advance to borrowers to complete the circle.

Armed with understanding the basics of Capital Adequacy, Risk Weightings and risk mitigation, facilitates understanding of the processes in place to distribute unlimited credit, or better known as unlimited debt. Banks are very capable in managing their capital needs to satisfy the capital adequacy requirements.

Banks do not actually create money. They distribute credit. Their ability to distribute credit used to be a function of the amount of deposits that they could attract. That was the next problem that stood in the way of limitless credit. This problem was solved through central bank “accommodation”, even before the advent of Basel I.

Banks are credit shops; they buy and sell credit. Banks operate on the basic principle of selling all qualifying credit on any given day and then try to balance the books at the end of the day. This they do by attracting deposits. They sell the excess, when deposits exceed their sales of credit, in the inter-bank market. Those banks experiencing a shortfall after exhausting all sources of deposits will access the inter-bank market for deposits. Obtaining a deposit from the central bank makes up a shortfall after exhausting the inter-bank market.

The process involved in obtaining such a deposit is normally described in complex technical language, but it remains just a deposit by the central bank at the bank with a shortfall. It is a structural given in the modern economy, that there will always be a daily shortage of available deposits. The shortage is made up by the central bank in terms of its liquidity policies towards the banks. The central banks would also penalise banks when they make use of this accommodation. Such penalties, hawkish or dovish, would be a function of prevailing monetary policy and will be expressed as an interest rate. Here, however, is the link in the chain; banks would normally need government securities as collateral to obtain accommodation, so banks will tend to hold fair volumes of government debt as “liquidity reserves”.

Think about it. Banks have no idea of exactly how much credit they will grant on any given day or what the level of withdrawals will be. So, a bank will not say, “lets see what deposits amount to for the day?” and then grant loans until the deposits have been used up. Any luckless, would be borrowers, would then have to wait until the next day to know if the bank managed to obtain enough deposits to grant them a loan. It just does not work that way. Banks sell credit first and then balance the books thereafter; there is no other way!

The economic and logical trap that creates the mirage of banks as money alchemists can be found in misinterpreting bank credit and fiat money as the same thing. They’re not. Every bank must balance its books every day. Credit sold must equal the sum of deposits taken, capital and central bank accommodation. It is no more complicated than that from a global perspective. The only money creation in this exercise is the accommodation by the Central Bank.

Here’s a sample from the Bank of Japan accommodation policy, where an “unlimited accommodation” policy has been in place for a long time. Available on the Home Page of the BOJ, by following this link, http://www.boj.or.jp/en/seisaku/04/pb/k041029_f.htm [this link has since been deactivated].

“[Monetary Policy Meetings]

October 29, 2004

Bank of Japan

(For immediate release)

________________________________________

At the Monetary Policy Meeting held today, the Bank of Japan decided, by unanimous vote, to set the following guideline for money market operations for the intermeeting period:

The Bank of Japan will conduct money market operations, aiming at the outstanding balance of current accounts held at the Bank at around 30 to 35 trillion yen.

Should there be a risk of financial market instability, such as a surge in liquidity demand, the Bank will provide more liquidity irrespective of the above target.”

The Central Bank is the only entity that can show a deposit to a bank on one side of its balance sheet and a “money” liability on the other side of its balance sheet. It is of no relevance for money creation how many debits or credits are created in the books of all the banks in the world on any given day. That is simply the turnover of banks. The end of day “accommodation” where central banks balance the books of banks is where the money creation happens. The existence of providers of credit beyond banks, such as Mortgage Lenders Freddie Mac and Fannie Mae, Corporate Finance entities such as used by GM and other “in-house banks” and large scale direct investments in securities from junk bonds to high quality mortgage securitisations have made the measurement of “money supply” in M2 and M3 susceptible to gross understatement of the actual “money creation” taking place. Credit derivatives, collateralised debt obligations and other exotic financial instruments, actively used by banks and other financial entities will not even appear on the radar. In the end it is better to follow trends in debt rather than the traditional money supply variables.

Large-scale stimulation of the economy through budget deficits (fiscal stimulation) and quantitative easing (monetary stimulation) would be expected to show up on the balance sheets of commercial banks as an increase in holdings of Government Securities. More so if overnight interest rates for banks are much lower than yields on Government Securities and the Fed promises lower rates for longer (the “carry trade”). It is therefore interesting to observe how holdings of U.S. Government Securities at all Commercial Banks [1] increased since the 1st quarter of 2001 with the recorded growth rate at 5.52% in Feb 2004 the highest growth rate in this series from its inception in Jan 1947. Observing this increase against the advent of the downturn in equities and subsequent recovery is most illuminating. The down trends in both Commercial Bank holdings of Government Securities and the DJIA may just be a very ominous signal. Note also a similar down tendency early in the first bear phase of the DJIA.

The explosive growth in purchases by banks of Government Securities is consistent with similar increases in the budget deficit, the trade deficit, mortgage debt, in fact almost all types of debt, all of which manifested in an equally stimulated aggregate demand, creating an illusion of a healthy growing economy.

The money tree belongs to the Central Banks and only them. They guard this power jealously. Banks cannot create money; they can only function as the conduit for the Central Bank’s credit stimulation policies, which in turn is derived from monetary policy as expressed by government. Ultimately all other financial intermediaries’ actions will be captured in the central bank accommodation provided to the banks. Knowing also that central banks can actually provide unlimited accommodation and banks just need to ensure capital adequacy, leads to understanding how an economy can be stimulated with unrelenting quantitative easing at any level of interest rates. Add to this the arrival of all new forms of electronic banking and internet banking, facilitating the distribution of credit in almost real time and you will get an idea of how efficient and dangerous debt stimulation has become. Finally add the fact that the Basel accords are being implemented right now all over the world, duplicating the quantitative easing/liquidity accommodation circle like an internet virus in every nook and canny of the world and then decide for yourself how concerned you should be.

Stealth tax is the name of every turn of the circle between quantitative easing and liquidity accommodation, stealth tax on your assets, stealth tax on your future income and even stealth tax on your children’s income and their children’s income. The “debt ceiling” of $7.4 trillion must be raised urgently, a couple more turns of the circle and US Congress will be asked to raise it again, and again, and again …

Sarel Oberholster

BCom (Cum Laude), CAIB (SA).

8 November 2004

E-mail – ccpt@iafrica.com

[1] Series USGSEC. Source: Board of Governors of the Federal Reserve System.